Yesterday, Dutch asset manager Robeco, which manages $180 billion in assets, adopted a policy excluding some companies active in thermal coal, oil sands and Arctic drilling from all its mutual funds. This is a welcome step coming from an asset manager which previously only applied exclusion criteria to its core sustainability funds and funds managed by its subsidiary RobecoSAM.

1. What is new ?

Robeco announced on September 24 in a press release and an article published on its website that it divested and will no longer invest in:

- companies that generate 25% or more of their revenues from thermal coal mining and power;

- companies that generate 25% or more of their revenues from tar sands;

- companies that generate 10% or more of their revenues from Arctic drilling.

These exclusions cover more than 90% of Robeco assets under management. Furthermore, the Dutch investor also announced that it would apply the following stricter exclusion thresholds for a small part of these assets, its core sustainability funds: 10% for thermal coal; 10% for tar sands; 5% for Arctic drilling.

2. Our analysis: a good starting point but more to do

a. Coal

The 25% coal share of revenues exclusion threshold that applies to coal companies is still higher than the 10% threshold applied by Robeco to its core sustainability funds, or by its subsidiary RobecoSAM.

But what matters more is that Robeco does not use the right metric to assess power companies’ exposure to coal and does not complement its relative exclusion criteria with more relevant measures that capture the absolute and forward-looking climate impact of a company. Some of the biggest coal producers—such as BHP Billiton (Australia) and Anglo American (UK)—or even companies planning new coal power plants—such as SDIC (State Development and Investment Corporation, China) or Mitsui (Japan)—slip through the cracks of this policy.

Robeco falls short of aligning itself with the best practices in the sector, for instance, those of global asset manager Amundi. On top of a relative 25% exclusion threshold, the French investor Amundi excludes all companies still planning new coal mines, coal plants or coal infrastructure, as well as companies buying coal assets and committed to fully phase-out from the coal sector by 2030 for the EU/OECD and 2040 worldwide.

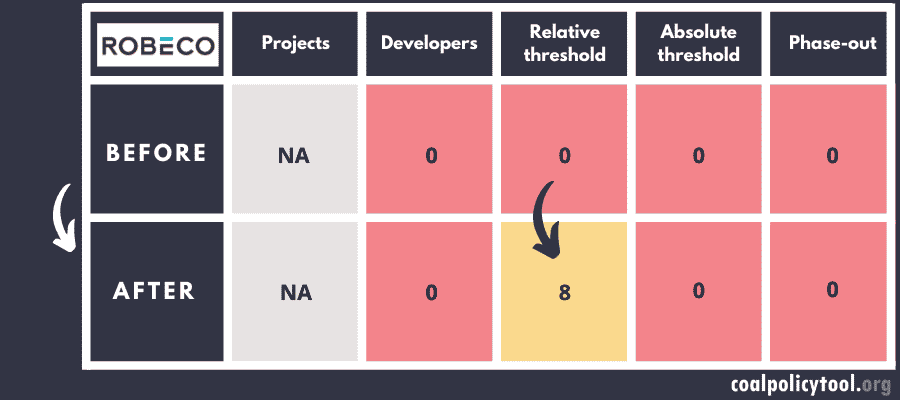

This is why Robeco’s scores on the Coal Policy Tool only change on one out of four criteria: the relative exclusion threshold criteria, from 0 to 8.

Robeco’s scores in the Coal Policy Tool

This table shows the scores of Robeco coal policy on four criteria of the Coal Policy Tool.

Robeco’s rationale, as expressed in its press release, is quite relevant and interesting:

“Although the preferred approach is to engage with companies, we believe it is very difficult to drive significant change at companies whose portfolios are skewed to coal or oil sands,” says Carola van Lamoen, Head of Robeco’s SI Center of Expertise. “Therefore, we prefer to put our efforts into sectors and companies, where we have more confidence that our engagements will be effective.”

The logical next step for Robeco is to immediately blacklist all coal developers: those companies are blatantly and openly betting on the failure of the Paris Agreement’s climate goals and have lost any credibility on the climate issue. According to the latest financial data available, from September 2019, Robeco had invested $326 million in 49 coal plant developers (the vast majority of the exposure of ORIX, its Japanese mother company).

It will also be necessary for Robeco to commit to a full phase-out from the coal sector by 2030 in the EU/OECD and 2040 worldwide, and to require remaining coal companies in portfolios to adopt a closure plan aligned with these deadlines, or face exclusion after a limited period of engagement.

b. Tar sands

The 25% tar sands share of revenues exclusion threshold applied for oil companies is still higher than the 10% threshold applied by Robeco to its core sustainability funds.

This threshold goes further than the 30% adopted by most asset managers with a tar sands policy so far. However, it still lags far behind Generali Investments, which adopted a 5% exclusion threshold. The Italian investor also excludes operators of controversial pipelines dedicated to the transport of tar sands.

c. Artic drilling

The 10% Arctic drilling share of revenues exclusion threshold applied for oil & gas companies is still higher than the 5% threshold applied by Robeco to its core sustainability funds.

This threshold also goes further than the 30% one adopted by most investors with a policy covering Arctic drilling. Still, it is higher than the 5% exclusion threshold adopted by the British asset manager Coutts.

However, as Robeco explains in its press release on this sub-sector:

“Although Arctic drilling is not fully commercially viable at this time and is not expected to be so in the near future, several big Arctic oil projects are still under development. This means the thresholds are largely pre-emptive and no companies are excluded under this policy today.”

This is why Reclaim Finance requires financial institutions to adopt an exclusion threshold of 15% but based on companies’ reserves in the Arctic, rather than the share of their revenues. This approach is also more relevant to tackle the tar sands, shale oil and gas, and deep-water extraction subsectors.

3. Our conclusion

By expanding the coverage of its coal policy from 10% to 90% of its assets under management, and by also taking this opportunity to cover tar sands and Arctic drilling, Robeco has made a crucial step in the right direction. Another good practice to highlight is the publication of the names of the 236 fossil fuel companies excluded by this new policy, which brings a welcome and much needed transparency to this kind of announcements. Nevertheless, the Dutch investor has a ways to go to align itself with the the Paris Agreement’s climate goals on fossil fuels, starting with the immediate exclusion of fossil fuels developers, and a commitment to phase-out these sectors by the relevant deadlines—2030 in the EU/OECD and 2040 worldwide.