Yesterday, the Japanese insurer MS&AD published its new “Sustainability Approach,” including its position regarding the coal industry, following in the footsteps of its peers Sompo and Tokio Marine, which adopted similar policies in the past week. MS&AD’s coal policy is closer to the one adopted by Tokio Marine, excluding the coverage and investment in new coal plants worldwide, with some exceptions. It has the same shortcomings since it does not cover other coal projects such as coal mines or coal infrastructures, nor, more importantly, any coal company at the corporate level.

1. What is new?

On September 30th, MS&AD published its new “Sustailability Approach” on its website, in which it mentions its position on the coal sector. This mention is relatively short and covers one concrete measure:

- The exclusion, “in principle,” of the insurance coverage and the direct investment in new coal power plants worldwide, with some exceptions.

MS&AD mentions that these exceptions could apply “after prudent consideration for cases where such plants are essential for the stable supply of energy to the country concerned.”

2. Our analysis: the bare minimum

MS&AD becomes the third global Japanese insurer to adopt a coal policy covering its underwriting activities, only days after its peer Sompo adopted a very weak policy on September 23rd and Tokio Marine on September 28th.

As with Tokio Marine’s coal policy, MS&AD commits to no longer insuring and investing in new coal plants worldwide, unlike Sompo’s policy, which only applies in Japan. As Tokio Marine and all big Japanese financial groups, MS&AD mentions that it “may” grant some exceptions. Nevertheless, the exceptions mentioned by MS&AD are more limited than the Tokio Marine’s, though they remain worrying. It is unclear how the assessment identifying whether a new coal plant is “essential for the stable supply of energy” will be conducted; there is a high risks of allowing the coverage or the direct financing of new coal plants still planned around the world.

More importantly, the policy does not cover the direct coverage or financing of new coal mines or new coal infrastructures, nor the provision of insurance coverage nor investments in coal companies. As with Sompo and Tokio Marine, this is the biggest fault in MS&AD’s coal policy, since most of the financial services are provided at the corporate level rather than at the project level.

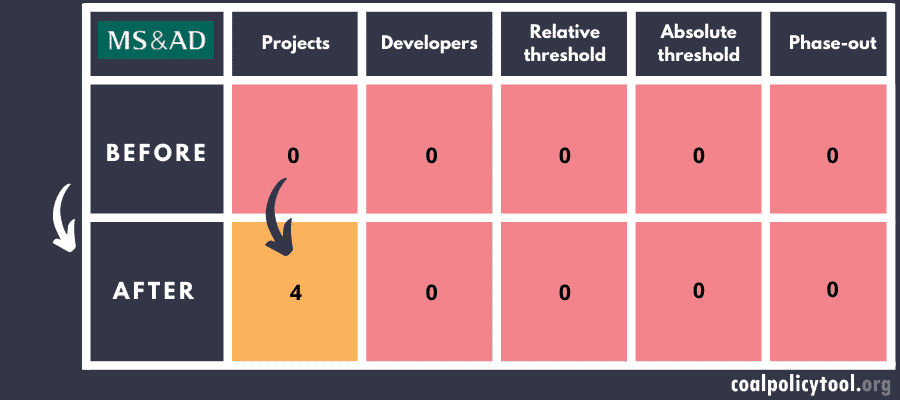

This is why MS&AD’s new coal policy only changes the score on one out of the five criteria in the Coal Policy Tool, the project level criteria, from 0 to 4.

MS&AD scores in the Coal Policy Tool

This table shows the scores of MS&AD coal policy as an insurer on five criteria of the Coal Policy Tool.

According to the latest financial data available from September 2019, MS&AD had invested $276 million in 1 coal plant developer: the Sumitomo Corporation.

MS&AD must quickly update its coal policy and get rid of all its loopholes at the project level and exclude all coal developers. To adopt a comprehensive coal exit policy and align itself with best practices in the sector, such as AXA’s, it must also exclude the biggest and most exposed companies in the coal sector and adopt a comprehensive strategy to phase-out coal by 2030 in the OECD and 2040 worldwide.

3. Our conclusion

As with Sompo and Tokio Marine, this new coal policy lags far behind the ones adopted by 20 insurers and reinsurers in Europe, the United States and Australia so far.

MS&AD must quickly revise this policy to get rid of this exception and start to tackle the bulk of the problem: the exclusion of the coverage and investments in coal companies, starting with coal developers. “Contribut[ing] to the achievement of ‘Paris Agreement’,” as it claims, would require MS&AD address the oil and gas sectors in its climate strategy at once.

As Yuki Tanabe, Program Director at the Japan Center for a Sustainable Environment and Society (JACSES), puts it: “SOMPO, Tokio Marine and MS&AD have adopted entry-level coal policies that are just at the starting line, now they must race to the top to ensure consistency with the long-term goals of the Paris Agreement. The three insurers should strengthen their coal policies and commit not to underwrite insurance for any new coal-fired power projects.”