The Royal Bank of Canada (RBC) published its first coal policy last Friday. It is the second Canadian bank to release such a policy after TD Bank and the first to cover corporate finance on top of project finance. Despite this, the policy is extremely far from doing what is needed to prevent climate chaos. Almost everything remains to be done for RBC to align with a 1.5°C trajectory.

1. What is new?

On October 2nd, RBC published its new ‘Policy Guidelines for Sensitive Sector and Activities’, addressing the coal sector. It covers the following measures:

- The end of the direct financing of new thermal coal mines, new Mountain Top Removal coal mining projects and new greenfield coal-fired power plants;

- The exclusion of companies deriving more than 60% of their revenues or power generation from coal, but only for new clients; and

- Exceptions for companies that are reducing their use of coal and/or reducing their GHG emissions and/or converting to high-efficiency, low emissions (HELE) or other technologies that lower GHG emissions.

- An endeavour to reduce its exposure to coal mining and coal power over time.

2. Our analysis

a. Coal: a missed opportunity to tackle corporate finance for real

RBC’s first coal policy is, unfortunately, very weak.

It was not too difficult for the bank to put an end to the direct financing of new coal projects since it was impossible to find any such deal financed by RBC in the past 20 years in the international financial database IJGlobal. Despite this, the policy contains a significant loophole rarely seen in the sector: it only covers greenfield new coal plants, and not browfield ones. The policy does not cover neither coal infrastructure projects.

The fact that the policy covers corporate finance and not just project finance, like many others such as the one from its Canadian peer TD Bank, would have been a positive sign if it had not been so weak and filled with giant loopholes.

- According to the latest Banking on Climate Change report, RBC channelled $314 million to the top coal mining companies, and $3 116 million to the top coal power companies between 2016 and 2019.

- RBC only pledges to “endeavour” and not firmly commit to reducing its exposure to coal mining and coal power companies over time. Besides, it only excludes companies with more than 60% coal exposure. This threshold is extremely high and has been rarely seen in the sector so far. But more importantly, it only applies to new clients and comes with enormous exceptions that most companies will be able to fill in one way or another. None of RBC existing clients, such as Glencore or RWE, will be impacted by the new policy.

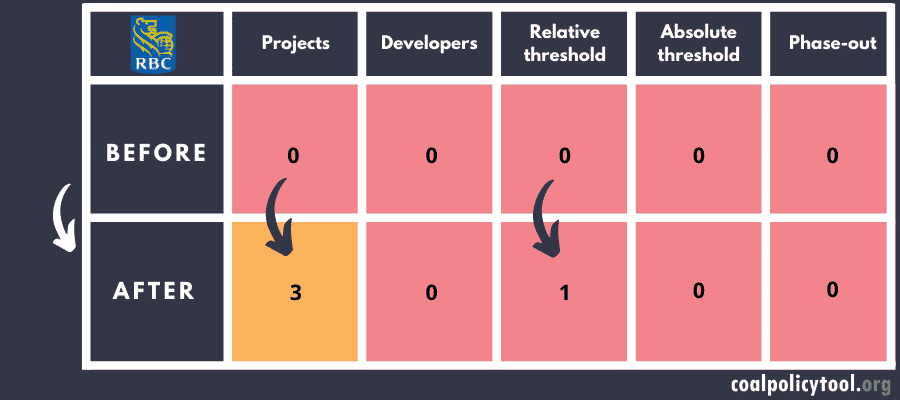

This is why RBC scores in the Coal Policy Tool only change for the first criteria regarding coal projects, from 0 to 3, and for the third criteria regarding the relative exclusion threshold, from 0 to 1.

RBC scores in the Coal Policy Tool

This table shows the scores of RBC coal policy on five criteria of the Coal Policy Tool.

On top of this, RBC policy also does not cover its asset management activities, despite RBC Global Asset Management being among the top 50 global asset managers with $492 billion of assets under management, according to Willis Towers Watson’s latest global rankings. RBC GAM had invested $416 million in 43 coal plant developers according to the latest financial data from September 2019.

RBC still has a long way to go to align itself with best practices in the sector, such as Crédit Agricole’s or Amundi’s. It must exclude all coal developers and the most exposed and biggest players in the coal sector. RBC must also adopt a comprehensive coal phase-out strategy by 2030 in Europe and the OECD, and 2040 worldwide. Its coal policy should cover existing clients as well as its asset management activities.

b. Oil & gas: a very limited scope

- RBC new policy also covers some oil & gas activities, but with a very limited scope. Despite recognizing “the natural and cultural significance of the Arctic ecosystem that is threatened by a number of factors, including climate change” and “the harsh conditions and fragile ecosystems (that) makes it a particularly vulnerable and challenging region for energy and resource development projects”, RBC chose to only prohibit the direct financing of projects in the Arctic National Wildlife Refuge (ANWR) following external pressure from public campaigns. The ANWR, previously protected from fossil exploitation, was only opened for drilling in August 2020. Projects found elsewhere in the Arctic only require enhanced due diligence and must be approved by a senior oversight committee.

- Project exclusions are insufficient and do not cover the bulk of the issue: the indirect financing to oil & gas companies active in the Arctic.

- The policy does not cover other unconventional oil & gas techniques such as the tar sands or shale oil/gas and let alone the need to also address conventional oil & gas. According to the latest Banking on Climate Change report already mentioned above, RBC was the second global banker of the top companies active in the tar sands, with $21 780 million channelled between 2016 and 2019. RBC is also the fifth global financier of fossil fuels overall with more than $140 billion provided in the same period.

RBC must fill its loophole regarding the Arctic and address its involvement in the tar sands by aligning with the best practices in the sector, such as BNP Paribas’ policy.

3. Our conclusion

All the loopholes identified in this analysis make this new coal policy quite useless to have any immediate concrete impact on RBC upcoming financing deals in the coal sector; and very limited regarding oil & gas, which is barely addressed. RBC must urgently go back to the drawing board and produce an improved and meaningful fossil policy covering all the fossil subsectors, and all its activities.