Caisse des Dépôts et des Consignations (CDC) has just announced new measures concerning its financing to the fossil fuel sectors on the occasion of Climate Finance Day. Reclaim Finance welcomes the efforts made on non-conventional oil and gas but points out the weakness of ambition concerning the oil and gas majors and denounces the lack of red line pertaining to companies developing new reserves, including in the riskiest sectors, such as shale oil and gas and the Arctic.

1. A missed opportunity to put an end to coal

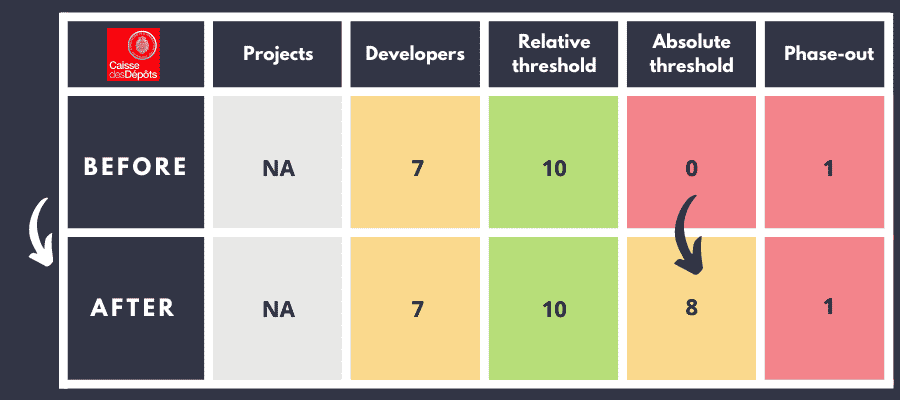

- The CDC complements its coal policy by adding absolute exclusion criteria to its existing relative criterion of 10%. While the 10 Mt threshold for mining is the right one, the 10 GW threshold for electricity-generating companies remains too high.

- Furthermore, if the CDC clarifies its exclusion of companies planning new coal-fired power plants, it could still support companies developing new mines and coal infrastructure, which can play a significant role in opening up new coal deposits or in bringing entire countries into the vicious circle of coal dependence, such as Kenya or Bangladesh. It is, therefore, a missed opportunity to align with best practices such as those of AXA, BNP Paribas or Crédit Agricole.

-

But it is regarding the quality of the overall exit strategy from the sector that the biggest hurdle lies: if the CDC mentions the right exit dates for the sector,

- it does not commit itself to exit coal, and its demands for a gradual exit only apply to invested companies;

- the request for an exit plan only covers electricity producers and, above all, is not accompanied by a threat of exclusion in the event of failure ;

- this development, therefore, remains far behind the growing list of financial players committing themselves to reduce their exposure to coal to zero and/or to exclude companies that have not adopted an exit plan by the end of 2021: Amundi, BNP Paribas, AXA, La Banque Postale AM or CNP Assurances to name but a few.

- The CDC is therefore really missing the opportunity to take the plunge and finally adopt a robust exit policy from the coal sector. It will, therefore, have to rectify the situation quickly.

Caisse des Dépôts’ scores in the Coal Policy Tool

2. The CDC refuses to act to halt the development of gas and oil

In particular, CDC joins OFI Asset Management and BNP Paribas with exclusions on non-conventional oil and gas.

- But CDC has gone much further than others, including BNP Paribas, by excluding companies deriving more than 10% of their combined revenues from shale oil and gas, oil sands and Arctic resources, across their entire value chain, not just fossil extraction.

- However, like many actors, it does not specify its definition of the Arctic zone. The protection of ecosystems in the Arctic obliges it to use the Arctic Council’s CAFF definition.

- While hundreds of companies are potentially covered, CDC is careful not to indicate the amount of its divestment corresponding to the relevant portfolio companies.

- In addition, oil and gas majors such as Total may not be covered, and CDC will therefore be able to continue to support them even if they develop new oil and gas projects, including in the sectors it identifies as the riskiest, such as shale oil and gas and projects located in the Arctic.

The CDC also excludes all greenfield oil infrastructure projects.

- It does not cover gas infrastructure, despite the fact that scientists are clear that to limit global warming to 1.5°C by the end of the century we must stop exploiting any new hydrocarbon reserves and developing any new polluting infrastructure today.

Finally, the CDC is asking companies in the publishing sector to provide a clear and credible transition plan.

- Regarding the approach to engagement with companies in the sector, the CDC is asking oil and gas companies to publish a clear and credible transition plan with targets for absolute reductions in their emissions, which is a good thing. However, it is not doing so, refusing to threaten exclusion and disinvestment, and also refusing to address angry issues such as the continued expansion of the sector and the new oil and gas projects that are still being planned.

3. Conclusion

Although the CDC has identified the challenges facing the hydrocarbon sector, the proposed measures are far from responding to the climate emergency. This is all the more questionable since it is a public financial institution, which should in this respect, show the way forward to all financial actors.